5 ways to upsize your savings as you spend

Tap & pay with SimplyGo for your public bus and train rides.

Use your Citi SMRT Credit Card or add your card to your mobile wallet for a seamless commute.

Plus, enjoy 5% savings* on your SimplyGo transactions with Citi SMRT Card.

For more details, visit here.

See how your savings add up with your Citi SMRT Card

| Categories | Base rate on qualifying retail spend |

Bonus rate on monthly qualifying retail spend ≥S$500 |

Total earn rate |

|---|---|---|---|

| Groceries | 0.3% | 4.7% | 5% |

| Online (excludes mobile wallet and travel-related transactions) | |||

| SimplyGo transactions | |||

| Taxis (including private-hire rides)# | |||

| Other qualifying retail spend | Nil | 0.3% |

Calculate your savings

Retail Spend

S$

earned

SMRT$

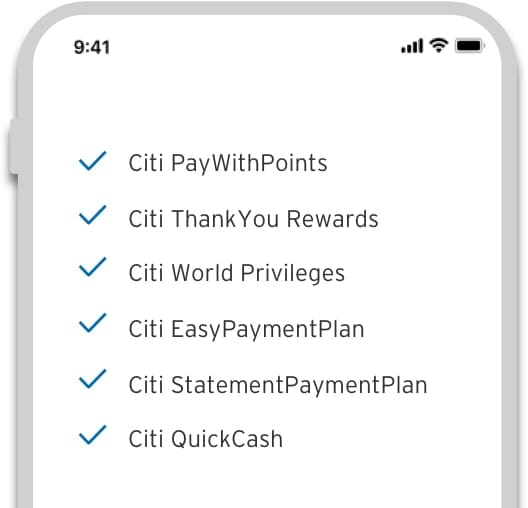

Top 4 Citi SMRT Card features

Citi World Privileges

Get deals and discounts with Citi SMRT Card

Citi PayLite

Turn your big purchases into small payments with Citi SMRT Card

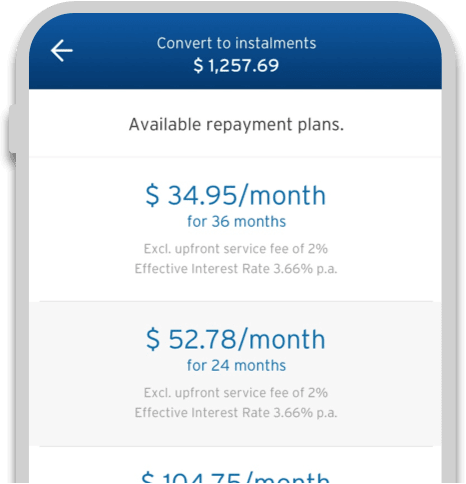

Citi FlexiBill

Convert your credit card statement retail balance into installments

Citi Quick Cash

Instant cash to get things done right away

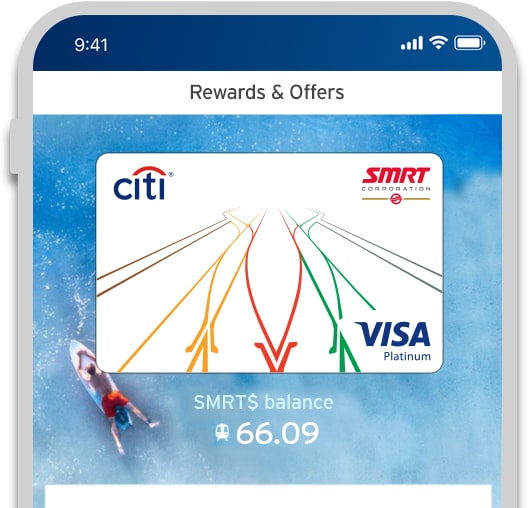

Steps to track your SMRT$ Rewards

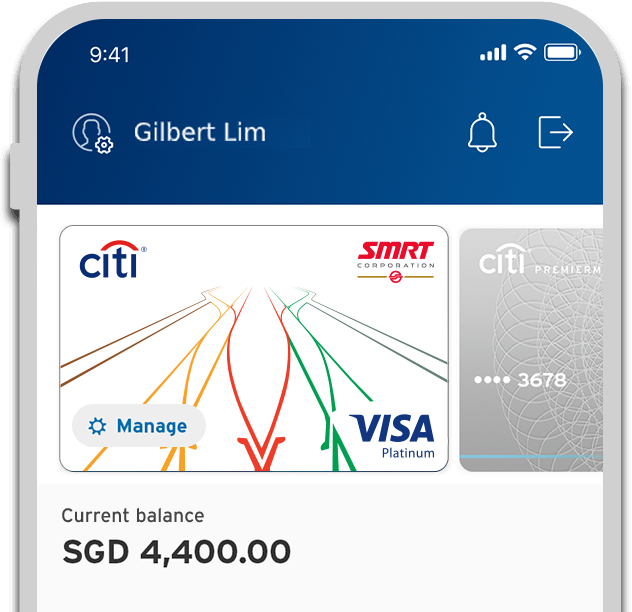

Everything at a glance

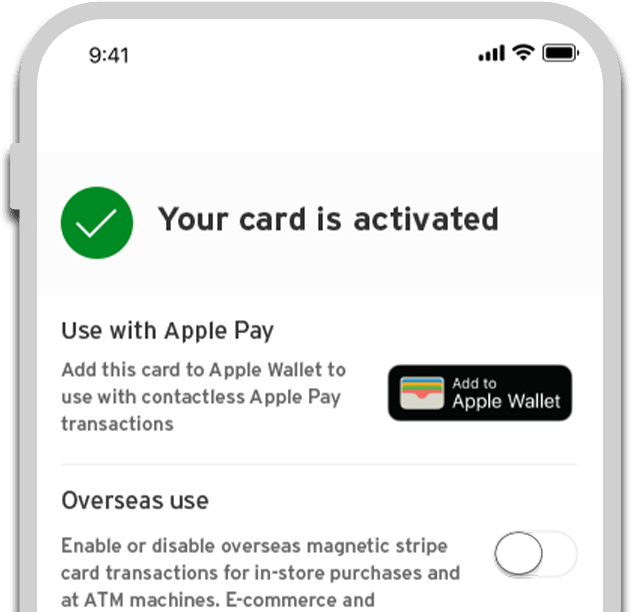

Activate a new card

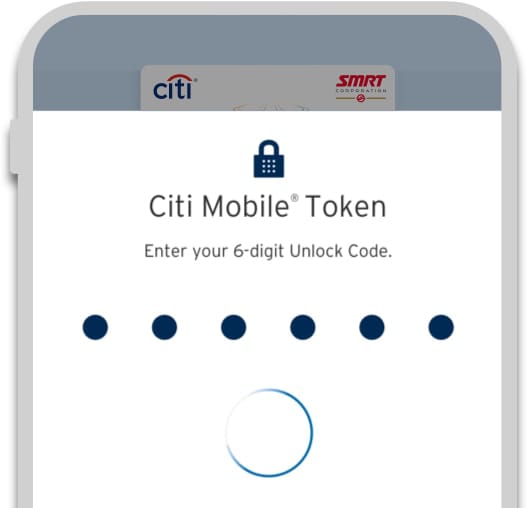

Secure your transaction

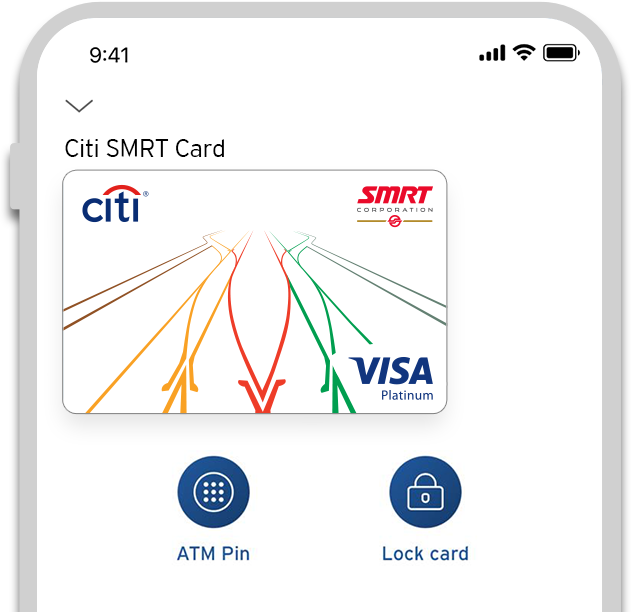

Lock and unlock your card

Powerful features on demand

Track your SMRT$ earned

Citi SMRT Card Promotions

Start your SMRT$ savings journey in less than 10 minutes

Get a new Citi SMRT Card from your phone or computer in an easy, paperless signup process

Basic fee of S$196.20

inclusive of 9% GST

(first 2 years waived)

Min. income S$30,000

(local/PR) or S$42,000

(foreigner) a year

Age 21 or older

Receive S$300 cash back^ when you apply and spend

Documents Required to Apply for Citi SMRT Card

Salaried employee

- A copy of your NRIC/passport

- Latest original computerized payslip or Tax Notice of Assessment or last 12 months' CPF statements

Self-employed

- A copy of your NRIC/passport

- Last 2 years’ Income Tax Notice of Assessment

- Last 3 months’ bank statements

- A copy of your passport and work permit (with minimum 6 months validity)

- A copy of utility/telephone bill or bank statement with your name and address

- Income Tax Notice of Assessment and latest original computerized payslip