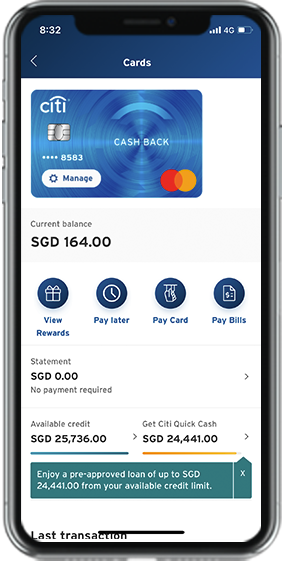

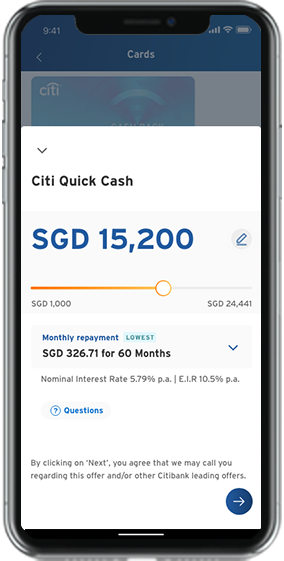

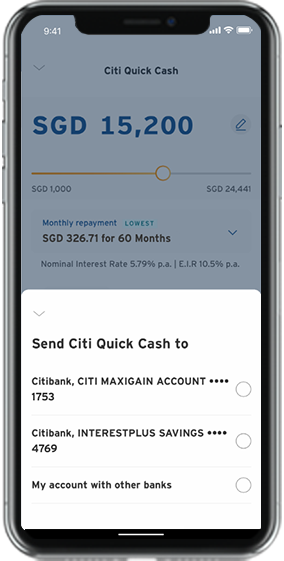

- Citi Quick Cash loan is drawn on your available credit limit in respect of your Citi Credit Card or Citibank Ready Credit account. You are required to have a Citi Credit Card or Citibank Ready Credit account to be offered a Citi Quick Cash loan.

- By clicking on 'Apply Now’, you will be applying for a Citibank Ready Credit account and for a Citi Quick Cash loan on such account.

- To find out more about Citibank Ready Credit account and its related fees and charges, please click here.

- If you wish to have Citi Quick Cash on a credit card account instead, you will need to apply for a Citi Credit Card first and contact us to book Citi Quick Cash on the card. To find out more about the type of credit cards you can apply, click here

- Home

- Banking

-

Credit Cards

- View all cards

- Travel

- Rewards

- Cashback

- Student

- Business

- Supplementary Card

- Refer your friend & get $50

- Commercial Cards

- View all privileges

- Citi World Privileges

- Citi ThankYouSM Rewards

- Rewards Redemption

- Petrol deals

- Additional services

- Pay your bills

- Manage your card

- Activate your card

- Increase your credit limit

- Mobile payments

- Submit CPF

- EZ-Pay

- Electricity Bills

- Mortgages

-

Loans

- Your Personal Loan Solutions

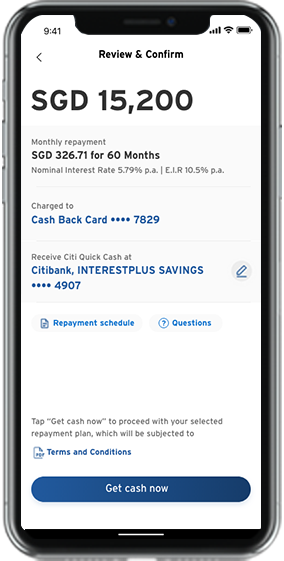

- Citi Quick Cash

- Citibank Ready Credit

- Citi Balance Transfer

- Other Lending Products

- Citi PayLite

- Citi FlexiBill

- Citi FlexiBuy

- Instalment Payment Plan

- Citi Debt Consolidation Plan

- Additional Services

- Apply for Citibank Ready Credit

- Citibank Ready Credit Card

- Activate your Citibank Ready Credit Card

- Manage your Citibank Ready Credit Account

- Increase your Credit Limit

- Bill Repayment modes

- Credit Insure Insurance

- Insurance

-

Wealth Management

- Investment products

- Unit Trusts

- Fixed Income Securities

- Foreign Exchange

- Citibank Premium Account

- Citibank Brokerage

- Citi Priority

- Citigold

- Advisory

- Wealth Solutions

- Your Team

- Privileges and Offers

- Citigold Private Client

- Wealth Management Products

- Wealth Advisory

- Privileges

- Citibank International Personal Bank