- Home

- |

- Banking

- |

- Instant Access

- |

- Online & Mobile Services

- |

- Online Services

- |

- Payments and Transfers

Outbound Funds Transfers

All it takes is a few clicks to initiate a FAST funds transfer to or from any of your personal Citibank Checking and Savings accounts to pay or transfer funds to anyone.

Transfer via

Citi Mobile® App

Login to Citi Mobile® App

Select "Payment & Transfer" > "Local & Internal Transfer"

Select a saved payee in the list to make the transfer OR click on "New Payee"

FAST option will automatically be shown under "Review & Confirm" if FAST transfer is available for the receiving bank/institution

Click on "Pay" after verifying payee details under "Review & Confirm"

Transfer via

Citibank Website

Login to Citibank Online

Select "Payment & Transfer"

Select an Electronic transfer payee under "To Account:" dropdown list to make the transfer OR click on "Add Payee"

Select "Transfer via FAST (Instant)" option before making the transfer

Inbound Funds Transfers

Pull funds from your other bank accounts into your Citibank Savings/Checking account via Citibank Online without the hassle of login to other bank's websites to initiate a fund transfer.

Transfer via

Citi Mobile® App

Login to Citi Mobile® App

Select "Payment & Transfer" > "Local & Internal Transfer"

Select your Citibank Savings/Checking account as the destination account

Select your external bank account (drawee) as the sending account*

FAST option will automatically be shown under "Review & Confirm"

Transfer via

Citibank Website

Login to Citibank Online

Select "Payment & Transfer"

Select your Citibank Savings/Checking account as the destination account

Select your external bank account (drawee) as the sending account*

Select "Transfer via FAST (Instant)" option before making the transfer

*This is only applicable if you have set up a drawee account previously. Please note that there is currently no option to set up a new drawee account.

There are several ways to pay your Citi Credit Card and Citi Ready Credit bills. The most convenient method would be via Citi Mobile® App.

Pay using Citibank Account

Via Citi Mobile® App

Login to Citi Mobile® App

Click on the Citi Credit Card/Citi Ready Credit Card which you want to pay to under your Account Dashboard

- (i) For Citi Credit Card, click on “Pay Card” > Select or Enter your preferred amount

- (ii) For Citi Ready Credit Card, click on “Make Payment” > "Cards, Bills & Loans" > “Loans” tab > Enter your preferred amount

Select your preferred Citibank account under ‘From account’ to make payment to your Citi Credit Card/Citi Ready Credit Card

Via Citibank Website

Login to Citibank Online

Go to the Citi Credit Card/Citi Ready Credit Card which you want to pay to under your Account Dashboard and click on “MAKE A PAYMENT”

Under “MAKE A PAYMENT & TRANSFER ”, select your preferred Citibank account under ‘From account’ to make payment to your Citi Credit Card/Citi Ready Credit Card

Select or enter your preferred amount for the payment

From Other Banks' Online Banking Platform (Pay via FAST transfer)

Login to your other bank/organisation online banking platform.

Click on their “Local / Fund Transfer” option and FAST transfer option if applicable

STEP 3

Under the payee details, select “Citibank Singapore Ltd” as the recipient and enter the following as Account Number

- (i) 16-digit Credit Card number; or

- (ii) 10-digit Ready Credit account number (starting with '1')

Authorise the setup if required and make the transfer

What is PayNow?

Forget about bank account numbers! With PayNow, you can send and receive money almost instantly using the recipient’s mobile number, NRIC/FIN, UEN or Virtual Payment Address.

To enjoy this convenience, link your mobile number or NRIC/FIN to your Citi account via Citibank Online or Citi Mobile App now.

How to receive money via PayNow:

- STEP 1 Login, select 'Payments & Payees' from the profile settings menu and select 'Manage PayNow' to get started.

- STEP 2 Choose either your mobile number or NRIC/FIN to be linked to your preferred Citi account or Citi Credit Card.

- STEP 3 Enter your account nickname, which will be displayed to sender, and confirm details.

- STEP 4 Key in the SMS OTP and you are all set to receive funds via PayNow.

-

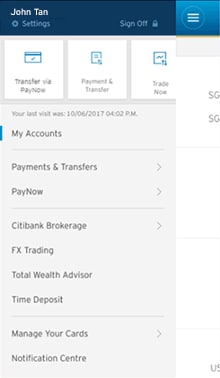

Login, access 'PayNow' from the 'Payments & Transfers' tab, and select

Login, access 'PayNow' from the 'Payments & Transfers' tab, and select

'Link to receive'. -

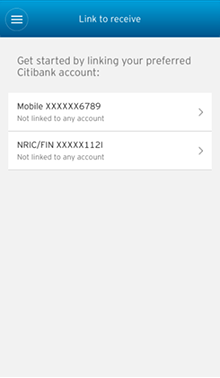

Choose either your mobile number or NRIC/FIN to be linked to your preferred Citi account or Citi Credit Card.

Choose either your mobile number or NRIC/FIN to be linked to your preferred Citi account or Citi Credit Card.

-

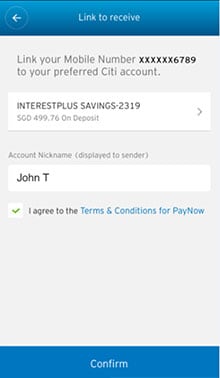

Select your preferred account, enter your account nickname, which will be

Select your preferred account, enter your account nickname, which will be

displayed to sender, and confirm details. -

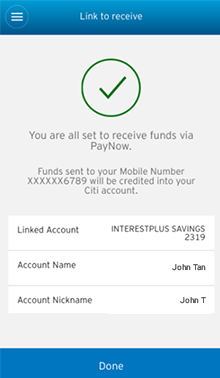

Key in the SMS OTP and you are all set to receive funds via PayNow.

Key in the SMS OTP and you are all set to receive funds via PayNow.

How to send money via PayNow:

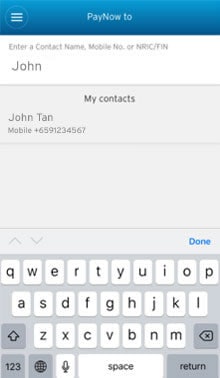

- STEP 1 Select ‘PayNow’ and login. Enter contact name from your contact list, mobile number, NRIC/FIN, UEN (with suffix if any) or Virtual Payment Address of the recipient.

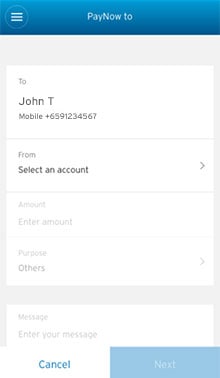

- STEP 2 Select the account to pay from and enter the transaction amount.

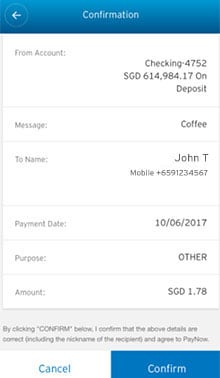

- STEP 3 Verify and confirm the transaction details.

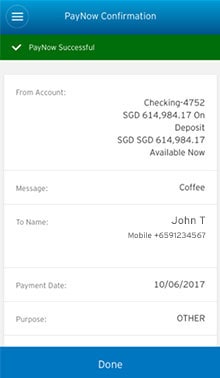

- STEP 4 Your PayNow transaction is now completed.

-

Login, access 'PayNow' from the 'Payments & Transfers' tab, and select 'Transfer via PayNow'.

Login, access 'PayNow' from the 'Payments & Transfers' tab, and select 'Transfer via PayNow'.

-

Enter the mobile number, NRIC/FIN or Virtual Payment Address of recipient, select the account

Enter the mobile number, NRIC/FIN or Virtual Payment Address of recipient, select the account

to pay from and enter the transaction amount. -

Verify and confirm the transaction details.

Verify and confirm the transaction details.

-

Your PayNow transaction is now completed.

Your PayNow transaction is now completed.

Please be informed that with effect from April 15 2019, Citibank Singapore Limited will operate under a new SWIFT Bank Identifier Code (“BIC”) and Bank Code for SGD payment instructions. The new BIC and Bank Code are set out in the table below.

To ensure that your transactions are processed successfully, you will need to select the respective Citibank’s BIC when you initiate new fund transfers from your Citibank Singapore Limited accounts and/or inter-bank payment instructions to Citibank Singapore Limited accounts. The changes are relevant to transactions involving a transfer of funds to Global Consumer Banking (Wealth management products and services, unsecured and secured products), CitiBusiness Banking accounts and Citi International Personal Bank accounts, and is applicable to all Fast and Secure Transfer (FAST),

inter-bank GIRO, MAS Electronic Payment System (MEPS) and incoming SGD Telegraphic Transfers.

Frequently Asked Questions:

1. Why is there a change in payment instructions to Citibank Singapore Limited?

Citi Singapore operates under two legal entities – Citibank N.A., Singapore Branch and Citibank Singapore Limited.

Citi Singapore has decided to maintain separate transaction settlement accounts for the two legal entities. As such, Citibank Singapore Limited will be issued a new SWIFT Bank Identifier Code (BIC) and a new Bank Code to be used for its SGD transactions. This means that you will need to use these new codes when you make any SGD transaction to your Citibank Singapore Limited ((Wealth management products and services, unsecured and secured products), International Personal Banking and CitiBusiness Banking account(s).

Kindly take note of the correct corresponding banking information, as listed in the table below.

Table 1 :| Currency | SGD | Others (No change. For reference only) |

|

| Before 15 April 2019 (Old BIC) |

On and After 15 April 2019 (New BIC) |

||

| SWIFT Bank Identifier Code (BIC) | CITISGSGXXX | CITISGSLXXX | CITISGSGGCB |

| Bank Code | 7214 | 9201 | - |

| FAST bank description | CITIBANK, N.A. | CITIBANK SINGAPORE LIMITED | - |

2. How does this affect my outgoing transfers?

Any existing outgoing transfers from Citibank will not be affected by the change in BIC and Bank Code.

However, from 15 April 2019 onwards, you will need to ensure you select the correct BIC (refer to Table 1 above) when you initiate new SGD fund transfers from your Citibank Singapore Limited account to other Citibank Singapore Limited and Citibank N.A., Singapore branch account. No action is required for your existing payment set up.

In the event you experience difficulties in transferring funds to your Citibank Singapore Limited account, please delete your existing setup and re-establish a new transfer instruction.

3. How does this affect my incoming transfers?

With effect from April 15 2019, the SWIFT Bank Identifier Code (BIC) will be changed to CITISGSL. This is applicable for all new SGD fund transfers (for SGD only) setup done via inter-bank payment platforms such as Fast and Secure Transfer (“FAST”), Inter-bank GIRO (“GIRO”), MAS Electronic Payment System (“MEPS”) and Telegraphic Transfers (“TT”) to Citibank Singapore Limited.

In order for incoming SGD funds/payments (for SGD only) to your Citibank Singapore Limited account(s) to be successfully processed, please provide the SWIFT Bank Identifier Code (BIC) as CITISGSL to the relevant parties.

Payments made to an account(s) with incorrect BIC will not be processed and you may incur additional charges.

For incoming transfers in other currencies, there is no change in current BIC Code (CITISGSGGCB) and Bank Code (7214).

4. Are there are any changes for my existing ‘account payee’ of another Citibank Singapore Limited account, already set up in my account?

No, there is no change to your existing account payee set up.

5. What should I do if I want to add a new payee of another Citibank Singapore Limited account?

If you are adding a payee via Citibank Online or Citi Mobile App, select Citibank Account (local) or ‘Electronic Transfer (GIRO/MEPS/FAST).

If you have selected to make a SGD payment via Electronic Transfer, please ensure you enter the correct SWIFT Bank Identifier Code (BIC).

6. What do I have to do when I transfer funds to another party’s Citibank N.A., Singapore Branch account from

15 April 2019 onwards?

There will be no change to the legal entity name and corresponding bank identifier codes for fund transfers to Citibank N.A., Singapore Branch accounts.

As such, you do not need to make any changes in any pre-established payees which you may have set up for regular funds transfers to Citibank N.A., Singapore Branch accounts.

However, please note that there will now be two bank names, Citibank NA Singapore and Citibank Singapore Limited, on the various inter-bank payment platforms (FAST, GIRO, MEPS, TT) To ensure that your transaction is processed successfully, kindly ensure that you select the correct Citi legal entity name and corresponding bank identifier codes when you initiate and/or receive payment instructions per stipulated in Table 1 as shown above.

1. Add Payee

- Before you can perform a Payment and Transfer for the first time, you will need to add a Payee.

- Select 'Payments and Transfers' on your top navigation.

- Find the ‘Add Payee’ option in the Manage Payee list.

- Key in the One-Time PIN1 (OTP) from your Online Security Device(OSD) or via SMS.

- Select a Payee Type and enter the relevant details.

- Authorize your transaction and follow the on-screen instructions to proceed.

- For adding Billing Organisation payees, you can opt to use an Online Authorization Code (OAC) to authorize the payee setup. OAC can be obtained via SMS, your OSD or through self-service phone banking with your Telephone PIN.

2. Fund Transfer using MEPS/FAST

FAST (Fast And Secure Transfers) is a mode of domestic funds transfer service that allows customers to pay anyone in Singapore, almost instantly. Start using this service by selecting the "Transfer via FAST" option when making a transfer to existing GIRO/MEPS/FAST payees on Citibank Online.

MEPS refers to a mode of transfer through the Monetary Authority of Singapore Electronic Payment System that allows you to transfer funds from your Citibank account to other bank accounts within Singapore on the same day, simply at a nominal charge of S$5.

3. GIRO and Standing Instruction

GIRO is an electronic bill payment option which allows you to transfer funds and will take about 2 to 3 working days to be effected. This mode of transfer can be used for scheduled payments to Individuals or Organisations in Singapore with no charges involved.

You will be able to set up a GIRO or Standing Instruction through your Citi Mobile App or Citibank Online.

4. Perform Bill Payments

Paying bills can be hassle-free. You can pay your utilities bills, telecommunication bills, taxes and membership fees easily via Citibank Online or Citi Mobile. With Citi PayAll, you can also use your Citibank Credit Card to pay selected billing organisations, rent, tax and many more on Citi Mobile.

5. Set up Citibank SMS Pay

Citibank SMS Pay is a secure & convenient way to pay your bills anytime, anywhere with just an SMS. Beat the queue and pay your Citibank Credit Card / Ready Credit bills using your non-Citibank account simply by sending an SMS. Find out more here.

6. Remittances / Telegraphic Transfers

Transfer your funds to Banks overseas at a low cost flat fee and no commissions, exclusively on Citibank Online and Citi Mobile. What's more, you will be able to view competitive foreign exchange rates online before confirming a transaction. Additional charges from the correspondent bank and beneficiary bank may apply. For more information, refer to

page.

7. Performing a Citibank Global Transfer (CGT)

Citibank Global Transfers is an online funds transfer service that allows you to transfer funds from your Citibank Checking, Savings or Ready Credit account to another Citibank account abroad instantly via Citibank Online and Citi Mobile.

8. Electronic Payment of Shares

Electronic Payment of Shares (EPS) is a convenient way of paying for your share purchases and receiving payment from the sale of your shares via Citibank Online.

- Online cheques can only be sent to a payee in Singapore. There is no service fee incurred for issuing an online cheque. Once the cheque is issued, your account will be immediately debited for the cheque amount. If you would like to cancel the cheque, you will need to inform Citibank to cancel the cheque.

- MEPS Instructions received after 5pm will be processed and effected on the next business day.

- Payments to billing organisations using a Citibank Credit Card as source of funds will not earn any rewards and/or rebates under any Citibank rewards or loyalty programme.

- This is applicable only for selected billing organizations.

- This is only applicable for participating countries with Citibank Global Transfer.

1 PIN refers to Personal Identification Number.

eGIRO

GIRO is an electronic direct debit mechanism used by billing organisations as a low cost means to collect payments. The authorisation for direct debit is a contractual relationship between a consumer and a billing organisation; banks help facilitate the arrangement to effect authorised GIRO deductions.

Starting November 2023, in addition to paper-based GIRO setup or cancellation, you will be able to apply for or cancel an existing eGIRO setup on your Citibank Singapore Limited account via the participating billing organisation’s website, within minutes. For more details, visit eGIRO (abs.org.sg).

What is eGIRO?

eGIRO stands for Electronic GIRO. eGIRO digitises the GIRO application process with an aim to significantly reduce the GIRO set-up turnaround time. This is a joint initiative by The Association of Banks in Singapore (ABS), Monetary Authority of Singapore (MAS) and Participating Banks.

- Specify your designated bank (Citibank Singapore Limited) for the eGIRO setup. This will redirect you from the billing organisation’s website to Citibank Online.

- On Citibank Online login page, log in with your user ID & password. Select the bank account that you wish to make the payment from and include other relevant details required to proceed with the setup (For example: End date, Maximum amount).

These details are required to process your eGIRO application and will be sent to the billing organisation. The screen will display information for your final confirmation. Fields which will be defaulted will be displayed on screen for your confirmation. Once you have confirmed the information, you will be redirected back to the billing organisation page and see a confirmation notification from the bank.

Can I set up or cancel an eGIRO instruction from my bank account(s) via Citibank Online or Citi Mobile® App?

No. Currently, you can only set up or cancel an eGIRO instruction via a participating billing organisation’s application or website.

Is there a fee by Citibank Singapore Limited to use eGIRO?

No, you will not be charged for any fees for setting up an eGIRO instruction via a participating billing organisation’s mobile application or website.

Will my paper submissions or existing instructions be migrated to eGIRO?

No. Existing instructions or new setups by paper forms will not be migrated to eGIRO. You may continue to setup or cancel GIRO via paper submissions as well.

Can I use a foreign currency account to set up eGIRO?

Currently, eGIRO can be setup against an eligible SGD Current Account / Savings Account (CASA).

Are there limits to eGIRO transactions?

Daily default limit of S$5k applies for eGIRO related debit transactions. You may call the bank using our hotline to increase or decrease the daily default limit, which is capped at S$200k. Additionally, as part of the eGIRO setup, you can setup transaction level limits as well.

I have a new token enrollment. Why am I unable to proceed with my eGIRO setup or cancellation?

eGIRO setup and cancellation requires authorization via the Citi Mobile® App. In case you have recently registered for mobile banking or have a new app (token) registration, a cooling period of 12 hours will apply before any eGIRO related setup or cancellations can be done.

Payments and Transfers

| Description | Daily Transaction Limit | Speed |

|---|---|---|

| Transfers within Singapore | ||

| Transfer to other's Citibank Accounts | S$ 200,000 | Instant |

| Transfer funds to other Bank’s/Organisation’s Accounts | S$ 200,000 | Transfer via FAST Almost instantly, within minutes Transfer via MEPS Instructions received before 5pm on a business day will be effected on the same day. (Instructions after 5pm or on a non-business day will be effected the next business day.) Transfer via GIRO 2 to 3 business days |

| Payment by Cheque / Bill Payment | S$ 200,000 | As some payments are sent via cheque, payments will take effect within 5-7 working days. |

| Transfer outside Singapore | ||

| Citibank Global Transfer | S$ 250,000^ | Instant |

| ^Depending on the rules and regulations of the country where the account is located, a lower limit may apply. | ||

| Telegraphic Transfer | S$ 250,000 | 3 working days |

Incoming funds transfer

To receive funds from an overseas or local party in a currency other than Singapore dollars, please provide the following details together with your name and account number to the remitting party:

Name of Beneficiary Bank: Citibank Singapore Limited

Country: Singapore

SWIFT address: CITISGSGGCB

In addition to the details above, please also provide the corresponding bank SWIFT address to the remitting party.

List of corresponding bank SWIFT addresses (depending on the currency):

| SWIFT Address | Corresponding Bank | Currency |

| CITIUS33 | NEW YORK | USD |

| CITIIE2X | DUBLIN | EUR |

| CITIGB2L | ZURICH | CHF |

| CITINZ2X | AUCKLAND | NZD |

| CITIAU2X | SYDNEY | AUD |

| CITIGB2L | LONDON | GBP |

| CITICATTBCH | TORONTO | CAD |

| CITIHKHX | HONG KONG | HKD |

| CITIJPJT | TOKYO | JPY |

List of Citibank Global Transfer (CGT) participating countries

| United States | Hong Kong | Korea |

| United Kingdom | United Arab Emirates | Singapore |

Click on  to expand and on

to expand and on  to minimise the details.

to minimise the details.

PayNow is a funds transfer service that allows customers of participating banks/organisations to send and receive Singapore Dollar funds almost instantly from one participating bank/organisation to another using just their mobile number, NRIC/FIN, UEN or Virtual Payment Address.

Yes, simply select Scan and Pay on Citi Mobile App to scan a QR which displays the PayNow logo. You can also select My QR to generate your own personal QR code which you can share with anyone who needs to send you funds.

Yes, PayNow is secure and adopts the same high security standards established by the banking industry in Singapore for other funds transfer services such as FAST and Interbank GIRO.

PayNow transaction limits to mobile number, NRIC/FIN & UEN are at a minimum of S$1 and a maximum of S$200,000 in a day.

PayNow transaction limits to Virtual Payment Address are at a minimum of S$1 and a maximum of S$5,000 as as non-bank financial institutions (‘NFI’) have a maximum load capacity of S$5,000. These load capacity controls are managed at NFI’s end.

Please see the tutorial guide linked here for a quick overview.

Please see the tutorial guide linked here for a quick overview.

No, you may transfer funds with PayNow only between participating banks/organisations. You may transfer funds between a participating and non-participating bank through other channels such as FAST or Interbank GIRO.

No. PayNow can only be used for SGD fund transfers between bank/organisation accounts of participating banks/organisations in Singapore. For foreign currency or overseas transfers, please choose Telegraphic Transfers or Citi Global Fund Transfers instead.

Yes, you can pay businesses with PayNow via our Citi Mobile® App just by keying in their UEN number. Please note that the business you wish to pay to must first have registered with PayNow. You will be required to enter a transaction description, billing reference number, or receipt number based on the business's requirements.

To download the Citi Mobile® App, click here.

The Unique Entity Number (UEN) is the standard identification number of a business entity or company entity that uniquely identifies this entity. For PayNow, some businesses may provide their UEN accompanied with a 3-character suffix. The suffix acts as an identifier to ensure that payments are made to the correct bank account.

Please approach the merchant or business to check if they accept PayNow as a form of payment, and the correct UEN to enter to make payment.

The status of your funds transfer will be reflected on your confirmation page and you may also check your transaction history on Citibank Online or Citi Mobile® App. You should also receive Citi Alerts for fund transfers (subject to the transaction value threshold that you have set) via email or SMS.

PayNow transfers are free. There are also no charges for linking your mobile number or NRIC/FIN to your Citi account.

Inform us immediately via Citibank Online so we can attempt to help you recover the funds to the best of our ability.

- Click on 'Messages'

- 'Compose mail' to send us details of your transaction and request to recover your funds

Note that funds transferred to an unintended recipient may or may not be recovered. The return of such funds is at the discretion of the recipient bank/organisation and subject to the consent of the recipient. As such, please take utmost care in ensuring the accuracy of the mobile number, NRIC/FIN, UEN or Virtual Payment Address, and the account nickname of the recipient before you confirm to proceed with each transfer.

If you have updated your mobile number with the bank, you will need to link your preferred Citi account again. Your old mobile number that was previously linked to receive funds via PayNow will be automatically unlinked in 7 working days from the time of update. You should instruct each party from whom you are expecting to receive funds through PayNow to transfer funds to your updated mobile number once it has been linked to your Citi account.

Yes, PayNow transfers are available 24/7.

Note : In rare cases, we may need to contact you if more information is required to process your transaction.

- S$ Savings Account

- S$ Money Market Account

- S$ Basic Banking Account

- S$ Checking Account

- S$ Citi MaxiGain Savings Account

- S$ Maxisave Account

- S$ Maxisave Sweep Account

- S$ InterestPlus Savings Account

- S$ Tap & Save Account

- S$ Step-Up Interest Account

- S$ Wealth First Account

- S$ Savings Account

- S$ Money Market Account

- S$ Basic Banking Account

- S$ Checking Account

- S$ Citi MaxiGain Savings Account

- S$ Maxisave Account

- S$ Maxisave Sweep Account

- S$ InterestPlus Savings Account

- S$ Tap & Save Account

- S$ Step-Up Interest Account

- Citibank Ready Credit accounts

- Citibank Credit Card accounts

- S$ Wealth First Account

Only the primary mobile number that is maintained with the bank can be linked to receive funds via PayNow.

Yes, a foreign mobile number can be used to receive funds via PayNow if the foreign mobile number is maintained as your primary mobile number with the bank.

No, passport numbers cannot be used to receive funds via PayNow.

If you intend to only send funds via PayNow, you do not need to link your mobile number or NRIC/FIN. However, if you would like to also receive funds via PayNow using your mobile number or NRIC/FIN, you would need to link your mobile number or NRIC/FIN to your Citi account.

If you have received money and do not know where it came from, you should contact us immediately. You should not utilise the money.

If we have been informed that someone else is trying to link the same mobile number or NRIC/FIN to an account with another bank, we will attempt to contact you within 3 business days to verify your mobile number or NRIC/FIN. If we fail to reach you within this period, we may unlink your mobile number or NRIC/FIN from your Citi account. Please see the PayNow terms and conditions here for further information.

The VPA proxy is a new PayNow proxy (other than Mobile number, NRIC/FIN, and UEN) that allows you to transfer to non-bank financial institutions (‘NFI’). The registration of the VPA proxy is done at NFI’s end.

PayNow is currently offered by 3 NFIs – Singtel Dash, GrabPay & Liquid Pay

FAST funds transfers can be made to and from these accounts :

- S$ Savings Account

- S$ Money Market Account

- S$ Basic Banking Account

- S$ Checking Account

- S$ Maxisave Account

- S$ Maxisave Sweep Account

- S$ InterestPlus Savings Account

- S$ Tap & Save Account

- S$ Step-Up Interest Account

- S$ Wealth First Account

- Citibank Ready Credit accounts

- Citibank Credit Card accounts (incoming only)

- CitiBusiness accounts (incoming only)

- Citibank Commerical Cards (incoming only)

FAST funds transfers cannot be made to and from:

- USD International Card accounts

- All loan and credit line accounts

- Citibank Credit Card accounts (outgoing)

- Corporate and CitiBusiness accounts (outgoing)

| Participating banks/organisations | Transaction Limits |

|---|---|

|

Per Transaction Limit

Daily Transaction Limit

Transfer limit to non-bank financial institutions (‘NFI’) accounts*:

|

FAST funds transfers lets you transfer or pull funds almost instantly among participating banks/organisations in Singapore.

| Local interbank transfers | |||

|---|---|---|---|

| GIRO | MEPS | FAST | |

| Speed | 2-3 business days | Within same business day | Within minutes |

| Daily Transaction Limit | S$ 200,000 | ||

| Per Transaction Limit | Minimum Amount: S$1 Maximum Amount: Daily limit applies |

Minimum Amount: S$1 Maximum Amount: S$200,000 |

|

- Login to Citibank Online

- Select "Payments & Transfers"

- Manage Payee list

- Add a payee under the GIRO/MEPS/FAST option with your payee details:

- Bank/organisation BIC code

- Account number

- Activate your payee by entering the One time PIN shown on your Online Security Device*

*OSD required for adding new payees, regardless of the transaction amount - "Make a payment & transfer" by selecting "Transfer via FAST" option

No, you can use the same GIRO/MEPS payee to do a FAST transfer.

Citi Mobile does not support this feature. Please login to Citibank Online to add a payee.

Yes, FAST funds transfer is available anytime, 24/7, even on Sundays and Public Holidays, at your convenience.

Note: In rare cases, we may need to contact you if more information is required to process your transaction.

Yes, you will receive Citi Alerts via email or SMS when you subscribe for the service on Citibank Online to receive Citi Alerts via email or SMS.

Inform us immediately via Citibank Online so we can attempt to help you recover the funds to the best of our ability.

- Click on 'Messages'

- 'Compose mail' to send us details of your transaction and request to recover your funds

Note that transferred funds are recoverable only at the discretion of the recipient bank/organisation and subject to the consent of the recipient. As such, please take utmost care in ensuring accuracy of recipient and recipient bank/organisation details inserted, before performing your transfer.

Citibank does not have this FAST feature at this point in time. You can still continue to pay your bills by selecting "Billing organisation" as your payee.*

*It may take up to 7 days to complete.

Future dated or recurring options are available on Citibank Online, but will be executed as GIRO transfers. Your account will be debited one day prior to the date and funds will be sent out on the actual day.

Future dated or recurring payment options do not apply for FAST transfer to non-bank financial institutions (‘NFI’) accounts.

FAST can only be used for SGD funds transfers between bank/organisation accounts of participating banks/organisations in Singapore. For overseas transfers, opt for Telegraphic or Citi Global Transfers instead.

You can utilise other modes of transfers such as MEPS to transfer funds from your Citibank account to another bank account within Singapore on the same day, at a nominal charge of S$5 via Citibank Online.

*For MEPS performed after 5PM on a business day, the funds will be transferred on the following business day.

Yes, FAST fund transfer is available 24/7 including non-business days such as Sundays and Public Holidays. The value date of a FAST fund transfer effected after 11pm on a business day or effected on a non-business day will be the next business day.

| Q: | A: |

|---|---|

| 1. What are daily funds transfer limits? | The daily funds transfer limits refer to the total amount which you can pay/ transfer each day from your bank account(s). |

| 2. What are the maximum daily funds transfer limits which I can configure? | Daily funds transfer limit

*Note: The total daily accumulative amount allowed for local transfers is capped at SGD 200,000 only. The following local transfer types will be accumulated under this limit – FAST, GIRO, MEPS, PayNow and Bill Payment. Refer to question 8 for more information. |

| 3. I have just opened my banking relationship with Citi. What is my default limit? | For new to bank customers, the default limit for all types of funds transfer is SGD 5,000. To increase the limits, please update via the “Manage Transfer Limits” link under the Payments and Transfers module. Please note that a 12-hour cooling off period applies. If there is a Citi mobile token registration, please note that you will not be able to perform cumulated transactions of more than SGD 1,000 for a period of 12 hours. |

| 4. When updating my limits, why do I see the error “Amount entered exceeds maximum limit” | The maximum limit configurable is up to the values indicated in question 2. If new limit entered exceeds the maximum allowed, this error message will be displayed. |

| 5. I have just enrolled for Citi Mobile® App with enhanced security but I am unable to increase my funds transfer limits. Why is that so? | For your security, there is a 12-hour cooling off period post enrolment of enhanced security function in Citi Mobile® App before you can perform any increase in funds transfer. |

| 6. Does the 12-hours cooling off period for funds transfer limits apply to limit decreases? | No, limit decrease requests will take effect immediately. The 12-hour cooling off period only applies to increase in funds transfer limits. This is intended to protect customers from scammers seeking to make unauthorised transactions. |

| 7. Can the cooling off period be shortened? | For your security, the cooling off period cannot be shortened. |

| 8. Why do I see a ‘Limit exceeded’ error when attempting to do a PayNow transfer or FAST transfer? | The following are a few scenarios which may result in this error:

|

| 9. Am I able to perform funds transfers above my set transfer limit? | Once a limit has been set, no transaction, or sum of transactions totaling an amount greater to the daily limit set, can be performed on the same day. |

| 10. What is an authorisation limit? | The authorisation limit refers to the amount which you can pay or transfer before being asked to authorize the transaction. It applies to each transaction you make and differs by transaction type. If the transaction amount is equal to or above the authorisation limit, you will be required to authorise the transaction using the Citi Mobile® App with enhanced security capabilities. If you have not enrolled for Citi Mobile® App with enhanced security capabilities, please log in to the Citi Mobile® App to set it up. |

| 11. What are the default authorisation limits? |

|

Yes, you can debit your Citibank Credit Card to make a bill payment to selected billing organisations. Under "Payments & Transfers" select "Billing organization" as your payee.

Citibank Global Transfer (CGT)

For transfers to Citi accounts overseas up to S$ 250,000 select "Citibank Global Transfer" as your Payee Type in Citibank Online. Just ensure that the account details of the international account recipient is on your payee list and has been activated with an Online Authorisation Code (OAC).

Telegraphic Transfer

For transfers out of Singapore or in a different currency within Singapore to other bank accounts, select “Telegraphic Transfer” as your Payee Type.

Yes, you may select 'Manage Payments & Transactions' and setup a recurring payment from your Citibank Savings/Checking account to pay your Citibank Credit Card bills. Choose between making the minimum payment or full payment.

Yes, you can select the option to pay or transfer the funds today or at a future date.

IMPORTANT NOTESIMPORTANT NOTES

For payments and transfers via Citi Mobile, the payee will first have to be added on Citibank Online. All payments and transfers are subject to the Citibank Online User Agreement. Some or all of the services (including payments and transfers) that may be accessed through Citi Mobile or Citibank Online may not be available during our scheduled maintenance times. In the event of such unavailability, you may call our CitiPhone Banking at 6225 5225 or visit a Citibank branch to conduct your banking transactions. Effective 1st December 2019, our agent support hours will be from 8am to 8pm. Emergency assistance will still be available 24-Hour for the selected services. Click here to find out more. Citibank exercises no control and assumes no responsibility for any delay, misconnection, variation in response times and connectivity of any Internet Service Provider (whether local or overseas) through which access to Citi Mobile and/or Citibank Online is effected. Citibank full disclaimers, terms and conditions apply to individual products and banking services.